Blogs

However, easy-of-explore, price away from purchases and you will one more level of privacy are around the top factors. Select one of your gambling enterprises in the list above and you can once you is satisfied with the new gambling enterprise have, subscribe and you can browse on the payment webpage. Make sure to simply put a cheque once, in both people otherwise digitally. For individuals who mistakenly put a great cheque more often than once, get hold of your lender instantly.

The present a house deals circulate quick. Now payments is also too.

Atm put relates to deposit a check personally in the certainly https://casinolead.ca/20-deposit-bonus-casino/ the bank’s ATMs. You will want to signal their label on the back of a check—a system labeled as endorsing the newest consider—ahead of playing with mobile put. Under your signature, it’s also advisable to generate something like “To possess cellular put merely.” Depending on their lender’s guidance, you’re trained to incorporate the institution’s identity.

EST on the a business date would be accessible to availability the brand new next day with no charge. Yet not, individuals who wanted reduced use of their cash is also opt-in for PNC Express Money so you can receive instant access on their money to have an additional commission. The cost to possess PNC Express Financing is 2% of each and every view amount more than $100, or a $dos dollars payment for look at count out of $25 so you can $100. Cellular take a look at depositing allows a buyers to save work by depositing a remotely on the portable because of a good bank’s cellular app. To your increase out of electronic financial, people can done of a lot popular banking characteristics on line or having fun with a good bank’s mobile app, along with placing checks.

Trip to generate a deposit to a telephone membership and you may/otherwise commissary account. I inform the research regularly, but advice can transform anywhere between position. Prove facts to the supplier you find attractive before making a great choice. Arvest Financial is actually a residential district-centered lender providing Arkansas, Kansas, Missouri and you may Oklahoma.

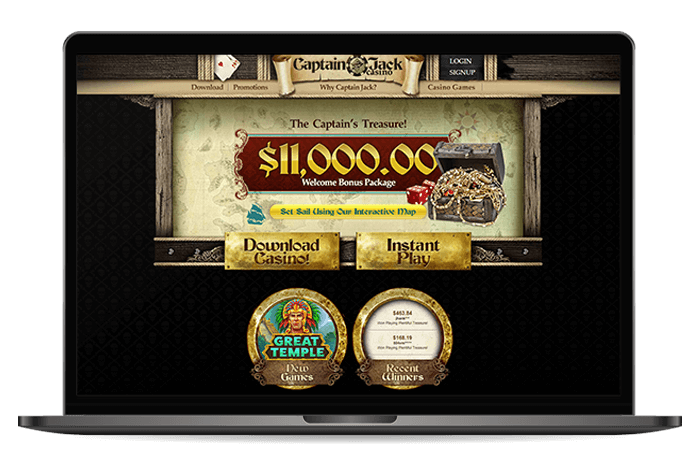

- While you’ll just ever before find the very reliable gambling enterprise operators to the all of our users, an additional covering of protection has never been a detrimental topic.

- While you are Financing You to definitely provides consumers which have payment-100 percent free entry to ATMs on the Allpoint and you may MoneyPass systems, the financial institution’s customers are unable to put bucks during the those people ATMs.

- Very loan providers, apart from online banks, will not enable you to put this type of on the internet.

- ET to your a corporate day was available 24 hours later at no cost[3].

- Same as no deposit incentives on your favourite gambling establishment, no deposit bonuses for the cellular is precisely the same thing which have the brand new different out of stating they via mobile.

The length of time does a mobile deposit capture?

If it happens you should block it together with your provider and you will when possible, tell your online casino so you can cut off people deposits if you don’t come across they otherwise and obtain a new portable. Keep episodes to have cheques from the financial institutions or other federally managed financial institutions can get affect digital cheque deposits. You can deposit an excellent cheque to your membership at any place from the delivering a graphic from it playing with an application on your smart cell phone otherwise tablet.

If you improve your lead put suggestions utilizing the report software, it might take up to 60 days to utilize your own changes. Deals ranging from enlisted consumers generally occur in minutes and usually perform maybe not happen purchase charges. Zelle and the Zelle associated marks are entirely belonging to Very early Alerting Functions, LLC, and therefore are used here under licenses.

Must i transform my commission approach just after installing the new account?

Screen your bank account, just in case the money doesn’t arrive once a two weeks, visit a bank branch and give the brand new report view because the evidence of your put. Personal, organization and you will bodies inspections are accepted for cellular deposit. Almost every other percentage models, including money purchases otherwise around the world monitors, may possibly not be acknowledged to own cellular deposit at the financial. At the same time, an over-all demands out of extremely loan providers is the fact that the look at shouldn’t become more than six months dated. The best banks have fun with solid security measures, and encoding, to guard your information and permit one to securely put inspections which have a smartphone.

Sometimes, merely an element of the consider get clear immediately, as well as the people clears another working day. For example, the initial $2 hundred from a deposit must be readily available for dollars detachment or check-writing the next business day. These types of banks build cellular take a look at finance offered immediately — otherwise, no less than, within the same time. Of a lot render 100 percent free exact same-go out cellular look at put, anticipate paying a tiny fee to have banking institutions that have instantaneous cellular view put availableness. Particular banking institutions allow you to put inspections on the internet as a result of their net portals. To take action, you’ll normally need to bring both parties of the recommended view having a cam or scanner, favor the wished deposit account and you may fill in your look at.