Together with interest rate chance, households’ resilience to help you earnings unexpected situations was analyzed playing with an odds of default (PD) model. There are numerous alternatives for estimating PDs: included in this is utilizing historic studies from genuine defaults and you can suitable an excellent logistic regression. The latest ECB set-up a pooled logistic regression model, according to financing top analysis and some macroeconomic signs, so you can imagine one-year-ahead probabilities of default getting mortgages. It model helps you receive out-of-take https://cashadvancecompass.com/installment-loans-tx/los-angeles/ to PDs significantly less than baseline and negative conditions (Graph step 3, committee b).

Graph step 3

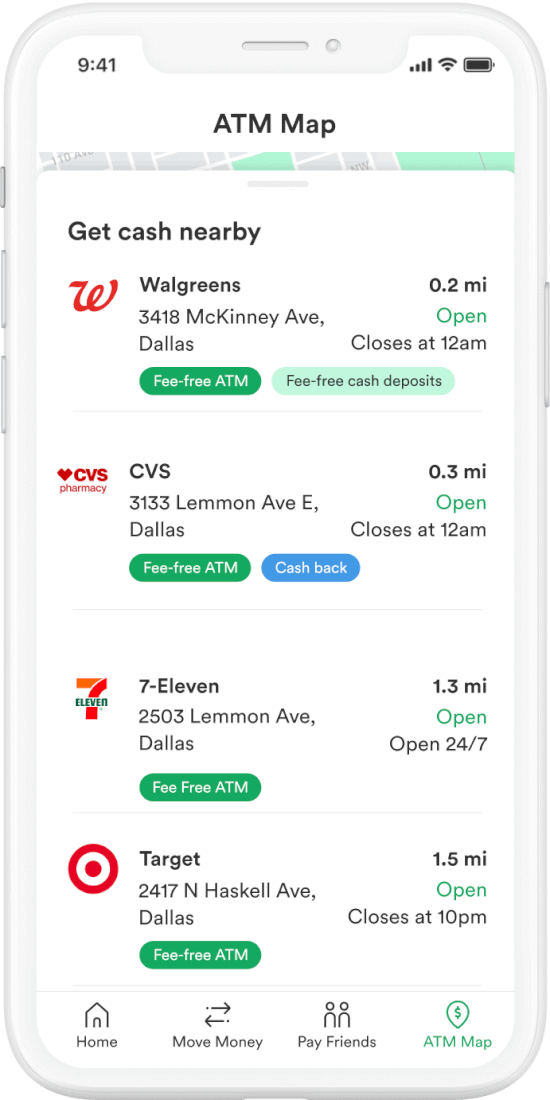

Monitoring lending requirements within origination provides a way of measuring financial chance delivering, and you may projecting home non-payments helps in determining threats from the household market

Sources: EDW, ECB and ECB data.Note: Based on study available for Belgium, Germany, The country of spain, France, Ireland, Italy, the netherlands, and you can A holiday in greece. These types of charts have fun with information on securitised mortgage loans by yourself (possibly resulting in choices bias) and may also perhaps not ergo become an accurate reflection regarding federal home loan avenues. Panel a beneficial: total weighted by GDP.

In the end, country-certain organization and you may structural attributes of homes markets could affect the brand new seriousness from cyclical weaknesses understood. These types of key has is RRE sector features (owning a home speed, regular readiness, and also the repairing out of housing finance), local rental industry limits, fiscal plan and purchase will cost you. They plifying and mitigating perception over the a house duration, plus the feeling often hinges on interactions with other policies (age.grams. monetary coverage). Any escalation in rates of interest carry out, for instance, enjoys an immediate and you may large effect on personal debt services burdens for properties when you look at the nations that have a high proportion out-of changeable price mortgage loans than in people in which repaired price mortgage loans prevail. While you are rising rates of interest within the places with predominantly repaired rates mortgage loans often connect with less the family obligations service weight getting current consumers, it does connect with a whole lot more financial success because the financial support prices you will to change shorter than simply financial pricing. At exactly the same time, supply-top properties (the price flexibility of the latest casing, controls and spatial believed) and you will demand-side situations (class and you can alterations in household structures) also are very important to RRE markets. Therefore, the latest ECB takes these types of under consideration in the determining RRE places, in addition to the outcome of new analytical devices shown more than.

4 Conclusion

Brand new difficulty away from RRE avenues and several streams by which unsustainable RRE ents you may threaten economic balance warrant the effective use of a package from faithful models. The fresh new ECB uses numerous units covering multiple chance classes discover a broad knowledge of this new vulnerabilities stemming out-of RRE places. Model-situated tactics fit easier indication-oriented exposure assessments and join a much deeper economic investigation. However, the fresh ins and outs regarding RRE markets indicate that probably the ideal analytical model can only just become a simplification of truth. This new ECB is actually for this reason attentive to the fresh new caveats and limitations regarding the newest patterns it uses and you will consistently refines its toolkit to reflect the latest best practices produced by most other organizations and you may instructional literary works.

References

Deghi, Andrea, Katagiri, Mitsuru, Shahid, Sohaib and Valckx, Nico (2020), Predicting Downside Risks to accommodate Costs and Macro-Monetary Stability, IMF Functioning Documentation, Internationally Monetary Financing, Washington, 17 January.

Dieckelmann, Daniel Hempel, Hannah, Jarmulska, Barbara, Lang, J. H. and you may Rusnak, ), Domestic Rates and you will Super-low interest rates: Examining the Nonlinear Nexus, mimeo.

Drehmann, Mathias, Borio, Claudio, Gambacorta, Leonardo, Jimenez, Gabriel and you will Trucharte, Carlos (2010), Countercyclical financial support buffers: exploring choice, BIS Doing work Documents, No 317, Bank to own In the world Settlements, Basel, twenty two July.

Jorda, Oscar., Schularick, Moritz and you can Taylor, Alan Meters. (2015), Leveraged bubbles, Journal off Financial Economics, Vol. 76, Point – Enhance, December, pp. S1-S20.

Lang, The month of january Hannes., Izzo, Cosimo, Fahr, Stephan and you will Ruzicka, Josef (2019), Anticipating the fresh tits: a separate cyclic general exposure indication to evaluate the likelihood and seriousness regarding monetary crises, Unexpected papers series, Zero 219, ECB, Frankfurt in the morning Main, February.