AHURI Look

Within its policies’ platform to the 2022 Federal election, the newest Australian Labor People has revealed a contributed guarantee program, capped from the 10,100 domiciles, where Commonwealth Bodies manage partner that have qualified lower to mid money home buyers to order between 31 and you can 40 per cent of your own to-be-ordered possessions. Condition created household guarantee techniques already are employed in Victoria, Western Australia, Southern Australian continent, Tasmania as well as the Work.

Shared collateral plans, whereby the home client offers the main city price of to find a beneficial house or apartment with a security mate, ensure it is lower income homeowners to acquire sooner as they you would like a good all the way down 1st deposit and then have all the way down constant homes will cost you. Yet not, with reduced collateral in the assets function homebuyers in addition to build an excellent faster money gain after they offer.

How do common equity strategies work?

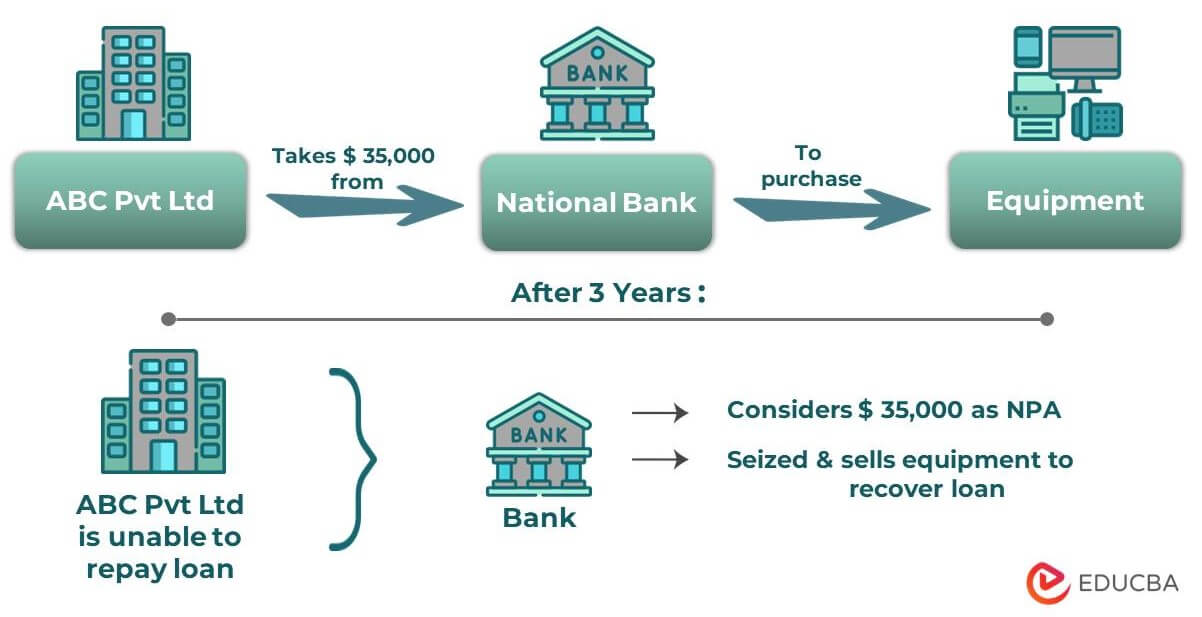

About personal equity’ model, that’s extremely commonplace in australia that is manage from the Australian state governments, this new homebuyer removes financing with the a percentage (typically 70% or maybe more) of one’s full cost of the house, as security mate has got the rest of the capital. In mortgage period the brand new homebuyer can obtain a great deal more guarantee within the the house or property (if they are able they) while the a stepping-stone to help you normal’, full possession.

On neighborhood equity’ design, the brand new homebuyer expenditures an amount away from property having an effective subsidy from the guarantee mate, always a variety of not-for-profit’ trust otherwise construction relationship. The brand new collateral mate holds the great majority away from possession features a continuing interest in the property.

Regarding the people equity’ model, the new homebuyer shopping a percentage of a property that have good subsidy regarding the collateral spouse, constantly a type of not-for-profit’ faith or houses association. New guarantee mate retains the vast majority from ownership and contains a continuous need for the brand new propertymunity Residential property Trusts (CLTs), that you can get in the usa while the Uk, is examples of which model.

In the event the householder chooses to sell, people develops on value of the home try minimal compliment of the application of predetermined price formulae in place of getting established open ple, in the us 55 per cent regarding CLTs work with the effortless formula that they take care https://paydayloanalabama.com/madison/ of the most guarantee in a manner that householders are only eligible to 25 percent of your own property’s preferred well worth toward resale. The latest intent is that, as opposed to the first subsidy dissipating in the event that domestic deal, the newest collateral partner’s ongoing focus ensures our home will stay reasonable to have upcoming homes.

Just who benefits from common equity schemes?

Government-backed common equity efforts was focused toward all the way down and you will average money houses who’ll sustain a good quantity of in hopes, long-label economic potential. In essence, this new shared guarantee effort provide an effective permitting hand’ for those unlikely is qualified to receive other types regarding assistance. These types of homes likely have profits less than, but not notably lower than, average incomes and buy properties regarding lower quartile so you can median price range.

Almost every other advantages for homebuyers are if they have problem with payments (e.grams. once they end up being underemployed) a loyal collateral companion can offer a safety net for example suggesting a repayment escape, stretching the borrowed funds or to acquire straight back a share of property’s equity.

Essentially, the new common security effort bring an effective providing hand’ of these unrealistic to get entitled to other styles of guidelines.

To possess governments, the benefits in aiding lower income households using mutual collateral strategies are that they relieve the stress on assisted homes applications, will get eradicate reliance on hobbies (age.g. beat demand for Commonwealth Book Recommendations) and you may, in which the household owner’s financial are fastened when you look at the that have a national financial, is go back modest payouts away from mortgage attention payments.

Government-supported shared equity preparations try a niche solution getting a choose clients from low income householders, and require so you’re able to equilibrium industrial sensibilities having social rules objectives when you look at the purchase to-be viable. They must be directed to the homes having income that are high enough to pay the lower home loan but not excessive that they you certainly will pay for a professional casing financing. The most household cost the brand new strategies can pay for need be leftover lower so as to not negatively turn on consult in the new housing market and push up home costs.